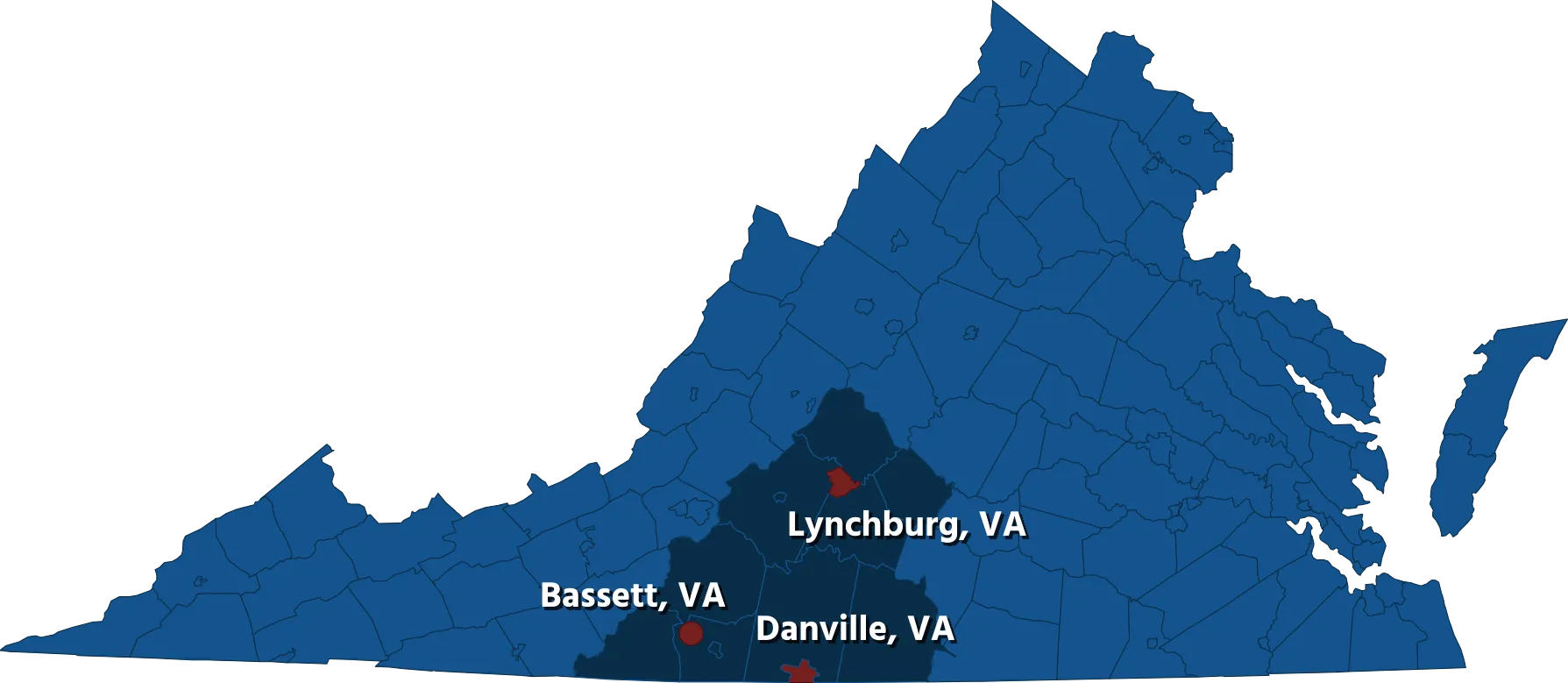

Elder Law Services in Bassett, Virginia and the Surrounding Area

Elder law encompasses an important aspect of estate planning that specifically addresses the needs of individuals and families as they grow older. It involves various issues related to aging, such as senior housing, home care, long-term care (including nursing homes), guardianships, health care documents, and Medicare and Medicaid.

Options for Senior Housing and Long-Term Care

Navigating the Challenges of Long-Term Care

As our population ages, many of us find ourselves confronted with legal matters concerning elder law, either for ourselves or our aging parents. Among the most critical concerns is the need for long-term nursing home care, which is typically not covered by standard health insurance plans. The cost of nursing home care can vary significantly depending on your location and the level of care required. In 2020, the national median cost for a private room in a skilled nursing facility was $105,850, with an average stay lasting a little over two years. Most individuals end up utilizing their personal or family assets to cover nursing home expenses until they are depleted, at which point they may become eligible for Medicaid assistance.

However, with careful planning, it is possible to protect your assets for the benefit of your spouse or children. One approach is to obtain long-term care insurance while you are still in good health and eligible for coverage. Additionally, it is important to ensure that you receive the entitled benefits from Medicare and Medicaid.

Medicare

Clients are frequently confused over the differences between Medicare and Medicaid. Though their names are very similar, the programs are quite different. Medicare is an “entitlement” program, a federal health insurance program in which most people enroll when they turn 65 years old. There are no financial qualification rules. Medicare has two primary parts: Part A and Part B.

Medicare Part A covers in-hospital care, extended care after a hospital stay, some home health care services, and hospice services. The rules for nursing home coverage are very strict and, in fact, Medicare pays for less than nine percent of nursing home care in this country.

Medicare Resources

Virginia Medicaid

Medicaid is a joint federal-state program that each state administers according to specific regulations. Unlike Medicare, Medicaid is not an entitlement program but rather a form of welfare. Eligibility for Medicaid is determined based on the submission of an appropriate application to the state. In Virginia, there are numerous Medicaid programs available, ranging from basic medical coverage to nursing home programs.

We offer assistance to seniors and their families in making difficult decisions related to long-term care planning, including exploring the possibility of Medicaid eligibility.

Exploring Senior Housing Options

Facilitating a move to senior housing for a parent can feel overwhelming, akin to orchestrating a rocket launch. The need to relocate often arises due to the passing of a spouse, declining health, or safety concerns. The first step involves realizing that the current residence is no longer suitable. Overcoming emotional attachments to a place can be challenging. Finding a new home that is both appealing and suitable poses its own difficulties, as does sorting through a lifetime's worth of belongings.

To make the transition easier, consider the following tips:

- Plan ahead and don't wait for a health crisis to initiate the process. The most seamless transitions occur when the individual who is moving takes the lead.

- Conduct a comprehensive assessment of the current situation, including evaluating physical care needs and financial resources. Consider the expenses associated with staying in the current residence, such as renovations, maintenance, rising utility bills, taxes, transportation, and food costs. Make a thorough list and determine whether it is more cost-effective to stay or move to a senior-oriented community.

- Take a phased approach. It often takes seniors more than a year to complete the move.

- Explore the available options for senior housing thoroughly. Senior living offers a wider range of choices than ever before.

Don't let yours or a loved one's hard-earned life's savings slip away! Book a call with us to learn more and see how we can help you protect what is important.

Sources